Two points: (1) This is a monthly expenses worksheet. So if you spend about $250 on holiday gifts in December, divide $250 by 12 months and enter $21 for holiday gifts in the appropriate place. Do the same for any annual/semi-annual expense, such as car license/registration or eye exam/teeth cleaning. (2) At the time, I used another worksheet to calculate my debt repayment from a list of all my debts. However, I've included a line entry for minimum credit card payment because that may be one of your basic monthly expenses if, like most of us, you have some credit card debt.

Okay, so here's the list:

Basic Living Expenses

Housing

1. Rent/Mortgage

2. Oil

3. Gas/Electric

4. Water/Sewer

5. Garbage pick-up

6. Basic Telephone

7. Basic Cable

8. Property Taxes

9. Property/Renters Insurance

10. Maintenance

Food

11. Groceries (incl. cleaning supplies and paper goods)

12. Lunches (work and school)

13. Pet food and litter

Dependent/Child Care

14. Alimony & Child Support

15. Babysitter/Day care

Transportation

16. Car payment(s)

17. Gasoline

18. Car maintenance/repairs

19. License/registration

20. Car insurance

21. Parking

22. Commuting costs

Medical/Dental

23. Insurance Premium/Deductible

24. Doctor/Therapist/Optometrist

25. Dentist

26. Prescriptions/Medications

Insurance

27. Life/(whole/term)

Clothing

28. Family Clothes

29. Uniforms (work/school)

30. Laundry/Dry Cleaning

Education

31. Educational Debt

Debts/Taxes/Fines/Surcharges

32. IRS or other

33. Fines, tickets, etc.

34. Credit card minimum monthly payment(s)

35. Any other

Subtotal of Basic Living Expenses: _____________

Non-Basic Expenses

A. Tuition

B. Hair Care/Cosmetics/Toiletries

C. Cell phone

D. Books/Newspapers/Magazines/Subscriptions

E. Tobacco

F. Liquor/Beer/Wine/Soda

G. Movies/Concerts/Plays/Videos/DVDs

H. Dinners Out

I. Dues/Memberships

J. Donations (religious/charity)

K. Gifts (birthdays/holidays)

L. Children’s allowance

M. Pet care/veterinary

N. Lottery

O. Hobbies/Lessons

P. Vacations

Q. Other (in my case, I had bank fees and had used an accountant to help me with my taxes in this particular year)

Subtotal of Non-Basic Expenses: __________

Total Monthly Expenses (Basic + Non-Basic): ____________

Total Monthly Income: _______________

Total Monthly Expenses: _______________

Monthly Excess/Deficit (Monthly Income minus Monthly Expenses): _______________

Be sure that your monthly income is based on what actually comes in -- not on what you think you might make. Be honest--both about what you spend and about what you earn. Once you are totally honest with yourself, everything else begins to fall into place.

At the O'Kitten household, we've been using the same basic format for about six years now. This month, our plan looks like this:

1/14 - 2/10/09 [I put in the dates so that we know exactly the period the plan covers]

Rent/Utilities (total 954.86):

Rent: 722.11

Electric: 65.00

Gas: 15.00

Phone/cable/internet bundle: 135.00

Renter's insurance: 17.75

Medical (total 290.00):

Medication: 140.00

Therapist/Doctor Co-pays: 150.00

Grocery (total 280.00):

4 weeks at $65/wk: 260.00

Cat food and litter: 20.00

Other (total 282.00):

Transportation/Metro Card: 20.00

Debt repayment: 262.00

Total expenses: 1806.86

Total income: 1814.00

Total expenses: 1806.86

Monthly income minus monthly expenses = 7.14

And remember--it's just money. A lot of days I have had to repeat to myself: "For today, I have everything I need." Try not to fret over the past or worry about the future, but stay in today.

2 comments:

Oy...we've been trying to do this, and it's SO DEPRESSING. On the plus side I've been cooking at home a lot, so that makes me feel better than spending money in restaurants.

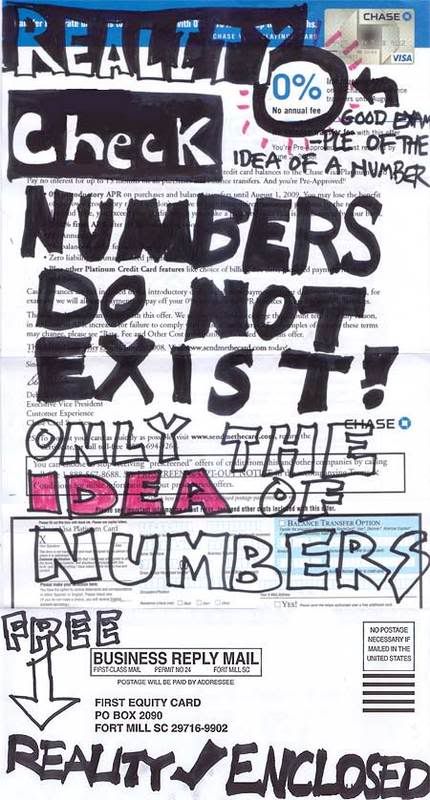

I love that credit card offer thing. Beautiful

and good for you, you're an inspiration.

okay--it was kind of depressing at first. but once we got a handle on it, it was great knowing we weren't going to run out of money between checks every month.

and cooking at home is great! definitely helps a lot.

i always pay the bills as soon as we get paid, and then take out cash for the month for the groceries etc (and gas, when we had a car). then i put that cash in envelopes for each week. not using the debit card for those expenses keeps it all in line--but that's another post. more to come!

Post a Comment